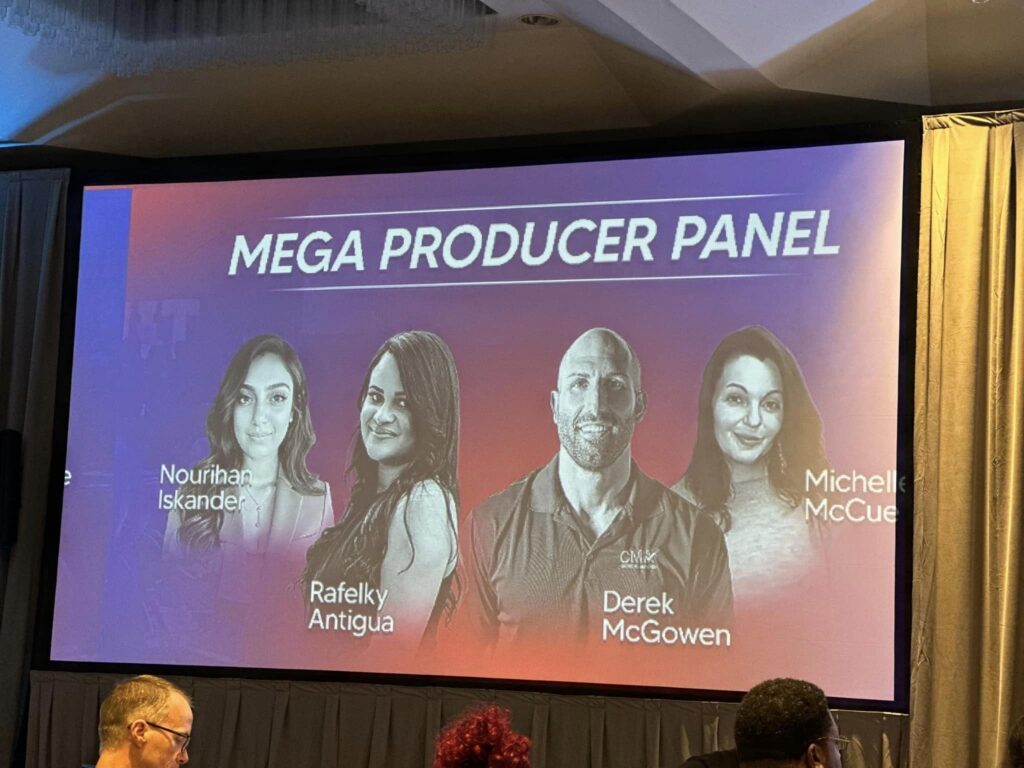

Honored to represent NEXA Mortgage – the #1 Mortgage Broker in America – at their Mega Producer Panel as their #1 Loan Officer back-to-back in 2023 and again in 2024.

Pictured above:

- Top and Middle-Left: stage at NEXA’s annual event, during the Top Producer’s panel

- Right-side: Thao (far-right) and I with Jonathon Haddad, the CEO of AIME (Association of Independent Mortgage Experts) – huge relationship that has opened up more doors for us to better serve our clients

- Bottom-left: Brad Lea – serial entrepreneur, sales expert, and founder of multiple companies.. learning from the best

NEXA has risen to the largest Mortgage Broker in History – Honored to be their #1 Loan Officer

McGowan Mortgage Team has made up the #1 Producer out of 2,700+ Loan Officers at NEXA across the country.

We couldn’t do this without our amazing Agents, Clients, and Partners – thank you for allowing us to be here to care for you 🙏

AIME showed us amazing support and had our segment as the feature they recorded – see video below.

Housing Market’s Reaction to the New President

I preface this with – there’s no leaning in either direction when it comes to political parties in this article. My job is to comprehend what’s going on in the world and how it can have an impact on Housing and Mortgages, then break it down and share those findings.. so I’m just keeping it on topic and will never get political in these write ups. We did just have an election and that was on many people’s minds, so I have a responsibility to speak on what that means in our industry.

The Republican housing plan has included they want to open up more government lands to build more homes.

There have been many unfinished home starts in recent times, so if the new campaign is able to provide more areas and make it easier for builders to build, that could be a step in the right direction for more home inventory.

The other focus the new campaign has is to cut government jobs, which would in theory cut down inflation. If that ends up going true to plan, then lower inflation would bring lower Mortgage Rates.

Still a lot has to happen to bring plans to life, but these are a couple things to keep an eye on. If we get more homes available and Mortgage Rates continue to improve, then it would make for a great climate for the Housing Market 🤞

Latest Inflation Report

Expectation for October’s monthly CPI Inflation was 0.3%…. and the results came in at 3.0% (technically 2.8%, which gets rounded to the nearest tenth).

This came with a flat reaction from the Mortgage Market as it was right on expectations.

While unpacking the data we were able to see that most everything actually looked great – except House Prices and Rent (aka: Shelter) – overall Inflation would be right in line with the Federal Reserve’s goal of 2.0% year-over-year.

If we can get House Prices & Rent under control, we’ve got Inflation fixed.

Both will get better with more inventory.

With more Inventory, house prices calm down, which brings Inflation down to the target, which brings Mortgage Rates down.

(The tricky part then is lower Mortgage Rates brings more Buyers back to the Housing Market which pushes House Prices higher)

2025 could be setting up as a great year for the Housing Market!

Where Have the First-Time Homebuyers Gone?! 🤔

Back in the 1980’s the average age of a First-Time Homebuyer was late-20’s.. today the average age is 38 years old!

Last year First-Time Homebuyers made up 32% of the Housing Market.. in 2024 FTHB’s make up just 24%, the lowest mark in 15 years!

What’s causing this? Price

With house prices at all-time highs and Mortgage Rates at recent highs, it’s become more expensive to dive into the Housing Market.

What can fix this? Inventory and Lower Rates

With more inventory, more options open up for FTHB’s – and prices will stop accelerating as quickly.

Lower rates will also help with affordability.

Keep in mind, the Millennial generation is the largest generation ever, so there are more people in the FTHB age range than ever before, so as the market improves, look for many FTHB’s to make up the transactions in the Housing Market.

Podcast with United Wholesale Mortgage (UWM)

We got the trifecta all in the same room!

UWM is the #1 Mortgage Lender in the country, so it only made sense to have the #1 Loan Officer at the #1 Mortgage Broker sync up and hop on their podcast.

We dove into how being a Mortgage Broker truly finds clients their best financing, opens up flexibility, and has changed the lives of many we’ve worked with – including my own.

I dove in on the ups and downs of the mortgage industry and how I needed what we’ve currently found to know we were doing our absolute best for our clients, therefore allowing me to operate at my fullest, which has completely changed our life as much as those we work with 🙏

Will send out the finished product once it’s published.

Do you know how much home you can afford?

Most people don’t... Find out in 10 minutes.

Today's Mortgage Rates