As we celebrate this season of renewal, hope, and fresh beginnings, we want to take a moment to thank you for being a valued part of our McGowan Mortgages family.

Whether you’re spending the weekend hunting for eggs 🐰, enjoying time with loved ones 💐, or just soaking in the spring sunshine ☀️—we hope your Easter is filled with joy, peace, and meaningful moments.

From our family to yours,

Happy Easter!

– The McGowan Mortgage Team 🏡

🏡 Thinking of Waiting to Buy a Home? 🤔

Here’s why that might cost you… 👇

📉 Less than 900,000 homes are currently for sale across the entire U.S.

📈 But we need nearly 4 million more just to meet demand.

That shortage is what’s keeping home values strong—and with new tariffs increasing the cost to build 🧱, prices aren’t going down anytime soon.

✅ Low inventory

✅ High demand

✅ Rising build costs

= Prices are likely heading UP, not down. 🚀

If the payment fits your budget, now might be the smartest time to buy.

You can always refinance later—you can’t go back in time to get today’s price. ⏳

⭐Get Approved for Your Home Loan! – CLICK HERE⭐

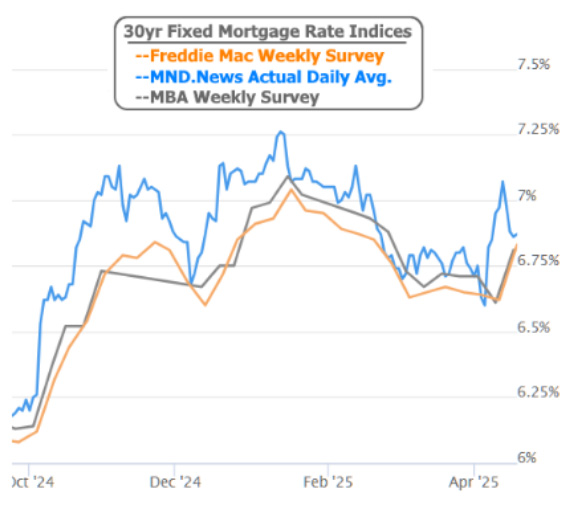

📰 Why the Headlines on Mortgage Rates Were All Over the Place Last Week 🏡

You may have seen some confusing headlines recently — some said mortgage rates were going down, while others warned of a spike. So what’s really going on?

👉 Both were technically true, but it all comes down to timing and how rates are measured.

📊 Weekly surveys (like Freddie Mac’s) showed lower rates because they averaged data from earlier in the week — before the spike happened. So those headlines felt a bit outdated by the time they were published.

📈 In reality, rates jumped sharply during the week — hitting the highest levels since February. That’s what we saw in real-time, day-to-day tracking.

⏱️ The good news? Rates have already improved a bit from those highs — we’re not back to early-April lows yet, but we’re headed in a better direction.

🔮 Looking ahead, there’s still uncertainty — especially around inflation and tariffs. The Fed is in a tricky spot: inflation says “raise rates,” while economic slowdown says “cut rates.” Until that settles, expect a bit of a rollercoaster.

Fed Chairman Gives a Cautious Update on the Economy

Last week, Fed Chairman Jerome Powell spoke—and his message wasn’t exactly upbeat. 😬

Quick Recap:

- 📈 Unemployment is rising more than the Fed would like

- 💸 Inflation is still hanging around, even though it’s better than before

- 🐢 The economy is slowing down

Powell made it clear: Inflation is still Public Enemy #1 🚨

He said, “Without price stability, we cannot achieve the long periods of strong labor market conditions that benefit all Americans.”

Translation? Don’t count on rate cuts anytime soon—even if the job market softens or the stock market slips 📉

But there’s a twist… 🔄

The European Central Bank just cut rates by 0.25% 📉, and global banks tend to watch each other closely. That puts pressure on the Fed to consider following suit.

What the market expects right now:

- 📅 2 rate cuts in 2025

- ✅ First cut: June or July

- ✅ Second cut: September

- 📆 The next Fed meeting is May 6–7, so we’ll know more soon!

Bonus Headline 📰

President Trump posted: “Powell’s termination cannot come fast enough.” 🗣️

He’s been critical of Powell’s leadership—and many feel the Fed has been slow to react over the past few years, causing more pain in the economy and especially in the housing market 🏡.

What this means for you 🧠💡

Mortgage rates are still bouncing around daily. If/when rate cuts begin, we could see them start to ease 📉. Until then, we’re watching the market closely and helping clients lock in when it makes the most sense ✅

🗓️ Months the Fed was Buying $120 Billion/Month in Bonds

I believe it could be stated that the Federal Reserve has been very slow to react to the economy and it’s created unneeded strain on the economy and housing market – I’ll explain

During COVID times, the economy really needed a boost as much of it was shut down – this is where the Federal Reserve stepped in to help by buying unfathomable amounts of Bonds to stimulate the economy – I’ll dive in below:

- Started:June 2020

- By this point, the Fed had ramped up to a steady pace of $80 billion/month in U.S. Treasuries

- And $40 billion/month in agency mortgage-backed securities (MBS)

= $120 billion/month total

- Continued through:October 2021

- This was the full period where they consistently purchased $120B/month.

🔻 Tapering began:

- Announced: November 2021

- Started: November–December 2021

- They reduced purchases by $15 billion/month initially, then accelerated tapering later in December.

🛑 Ended:

- March 2022

- By this point, the Fed had fully stopped new asset purchases in preparation for rate hikes.

💡 Quick Summary:

- $120B/month bond purchases: June 2020 – October 2021

- Tapering: November 2021 – March 2022

- Fully stopped purchases: March 2022

However, the economy/financial markets were back to pre-COVID levels around the end of 2020/early 2021 – so why was the Fed artificially still pouring money into the markets for another year or more?!

💰 Why Was the Fed Buying Bonds?

The Federal Reserve bought bonds during the pandemic (and in past crises too) as part of a strategy called Quantitative Easing (QE).

Here’s why they did it:

- 🛑 To Lower Interest Rates.

- When the Fed buys Treasury bonds and mortgage-backed securities (MBS), it increases demand.

- Higher demand → higher bond prices → lower yields (interest rates).

- Lower rates make it cheaper to:

- Get a mortgage 🏡

- Borrow money 💳

- Refinance loans 🔁

- ➡️ Goal: Stimulate the economy by making money cheaper and more available.

- 📉 To Support the Housing Market.

- By buying MBS, the Fed directly lowered mortgage rates.

- That helped keep the housing market strong during uncertain times.

- 🧠 To Calm Financial Markets.

- The massive bond-buying signaled to investors that the Fed would do “whatever it takes” to keep markets stable.

- That boosted confidence and reduced panic during the early COVID days.

- ⚙️ To Increase Liquidity.

- Buying bonds injects cash into the financial system.

- That cash flows into banks, businesses, and consumers — helping keep the economic engine running.

🧩 The Big Picture:

The Fed used bond-buying as a crisis tool to:

- Keep interest rates low

- Boost lending and investment

- Stabilize the economy during COVID shocks

⚠️ Downsides of the Fed Buying Bonds

- 💸 Inflation Risk.

- Pumping trillions of dollars into the economy increased money supply.

- When too much money chases too few goods, prices go up.

- This contributed to the inflation spike we saw in 2021–2022.

- 📈 Asset Bubbles.

- Ultra-low interest rates encouraged people to take on more risk.

- Stocks, real estate, and crypto surged — some argue they became overvalued.

- When the Fed started pulling back, some of those prices corrected sharply.

- 🏦 3. Distorted Markets.

- The Fed was such a massive buyer that it artificially influenced bond prices and suppressed yields.

- This made it harder for markets to accurately reflect risk and real supply/demand.

- 🧷 Hard to Unwind.

- Once the Fed buys trillions in bonds, it becomes tricky to unwind that without shocking markets.

- As we saw in 2022, trying to raise rates and stop bond purchases (aka quantitative tightening) can cause:

- Bond market volatility

- Mortgage rate spikes

- Stress on banks and financial institution

- 💼 Ballooning Fed Balance Sheet.

- The Fed’s balance sheet grew from ~$4 trillion to over $9 trillion at its peak.

- This raised concerns about:

- Long-term debt sustainability

- Fed’s influence over markets

- Limits to its ability to respond to future crises

- 🤔 Moral Hazard.

- Some critics argue that backstopping markets too aggressively creates a sense that the Fed will always step in — which can lead to:

- Excessive risk-taking

- Weaker financial discipline

- Some critics argue that backstopping markets too aggressively creates a sense that the Fed will always step in — which can lead to:

🧩 In Short:

The Fed’s bond buying helped avoid a crisis, but it also:

- Fueled inflation 📊

- Distorted interest rates 🏦

- Created challenges for the future 💣

📅 Anticipated Timeline for Rate Cuts

While the Fed has not specified exact dates, market analysts and economists suggest the following potential schedule:

- First Cut: Possibly in June or July 2025, contingent on economic indicators such as inflation and employment data.

- Second Cut: Likely in September or November 2025, depending on the evolving economic landscape. Reuters

⚖️ Factors Influencing the Fed’s Decision

Several factors are contributing to the Fed’s cautious approach:

- Inflation Concerns: Recent tariff policies have led to increased inflationary pressures, complicating the Fed’s efforts to stabilize prices.

- Economic Growth: The Fed has revised its 2025 GDP growth forecast downward to 1.7%, indicating a slowing economy.

- Unemployment Rates: Projections suggest a rise in unemployment to 4.4%–4.5%, which could prompt the Fed to consider rate cuts to support the labor market. Financial TimesInvestopedia

Fed Chair Jerome Powell has emphasized a “wait-and-see” strategy, stating that the central bank will monitor economic developments closely before making further adjustments to interest rates. AP News

The next FOMC meeting is scheduled for May 7, 2025, where further insights into the Fed’s monetary policy direction may be provided.

✅ Why Fed Rate Cuts Can Help Lower Mortgage Rates

- Investor Confidence

When the Fed cuts rates, it’s signaling that it’s trying to stimulate the economy. This can cause bond yields (like the 10-year Treasury) to fall — and mortgage rates follow those yields closely. - Lower Borrowing Costs for Banks

A lower Fed Funds Rate means banks can borrow money more cheaply. That often trickles down to consumers through lower loan and mortgage rates. - Slower Economy = Lower Inflation = Lower Rates

Rate cuts typically happen when the economy is cooling off. Lower inflation expectations help bring mortgage rates down as well.

⚠️ But… It’s Not Instant or Guaranteed

Mortgage rates are based on market expectations, not just Fed decisions.

If inflation is still high, or if bond markets are nervous, mortgage rates might stay elevated even after a Fed rate cut.

Other factors like tariffs, job numbers, and global events can keep mortgage rates stubbornly high.

🧠 In Plain Terms:

Yes, rate cuts help—but mortgage rates will only fall if the broader market believes inflation is under control and the economy is cooling.

Do you know how much home you can afford?

Most people don’t... Find out in 10 minutes.

Today's Mortgage Rates